Financial claims for recovering losses suffered in CFDs and Investment Certificates

Let Martingale Risk help you claim what’s rightfully yours.

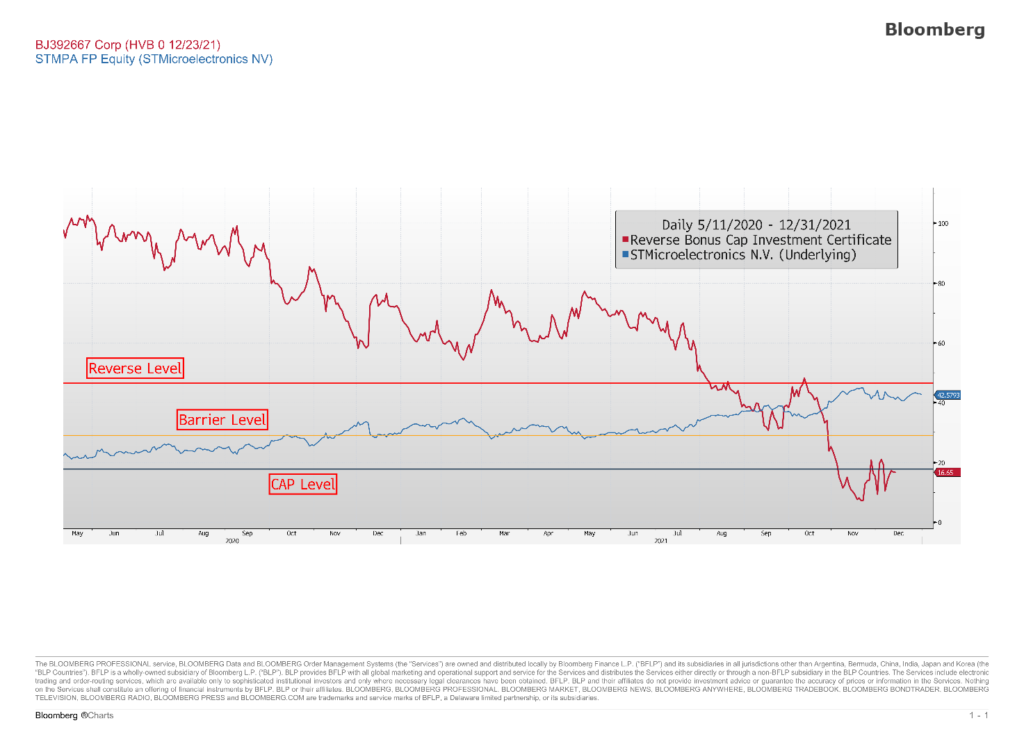

Instruments like CFDs (Contracts for Difference) and Investment Certificates are complex derivatives that link their performance to underlying assets like stocks, indices, commodities or even cryptocurrencies.

This means that fluctuations in these underlyings can directly impact the value of the derivative. Most notably, many derivatives involve the use of financial leverage, amplifying gains but also magnifying losses. For instance, if an underlying drops by 10%, a 10-times leveraged derivative would result in a 100% loss of your investment. These features make derivatives unsuitable for inexperienced and/or risk-adverse investors.

While Investment Certificates are exchange-based complex instruments, CFDs are over-the-counter derivatives, in which the intermediary is the direct counterpart of the investor. CFDs operations are settled under the so-called margin system, meaning the investor will pay only a fraction of the contract’s value but, on the other hand, the impact on his savings will be a multiple of the performance of the underlying.

Types of Financial Claims We Handle

Equity Investments

Investing in company shares involves market volatility risks. When intermediaries fail to disclose risks tied to high-risk entities, such as Air France-KLM, they may be held liable for resulting losses.

Bonds

Risk levels in corporate bonds depend on the issuer’s creditworthiness. High-risk bonds, such as those issued by SNS Bank N.V., require clear risk disclosure by intermediaries to avoid liability for investor losses.

Free non-binding preliminary analysis by a specialized consultant

Get Started with Confidence

Martingale Risk is here to help you fight financial injustice: complete the form below to start your journey toward rightful compensation.