Financial claims for recovering losses suffered in Bonds

Let Martingale Risk help you claim what’s rightfully yours.

Corporate bonds allow investors to lend capital to a company, which involves returning it at maturity together with periodic interest. In terms of risk, these bonds can be divided into several categories, with different characteristics depending on the credit quality of the issuer and the nature of the security.

Bonds classified as investment grade (highly rated) generally have a lower risk of default and a lower yield, as they are issued by financially sound companies. In contrast, non-investment grade or high-yield (lower rated) bonds offer higher yields but carry a higher risk, as they are issued by companies with a weaker creditworthiness.

In addition to the rating classification, the degree of risk is influenced by the structure of the bonds. Senior bonds, which can be secured or unsecured, have a priority of redemption in the event of issuer bankruptcy. Senior secured bonds are backed by specific assets of the company, offering a higher level of security than unsecured bonds, which are not backed by specific collateral.

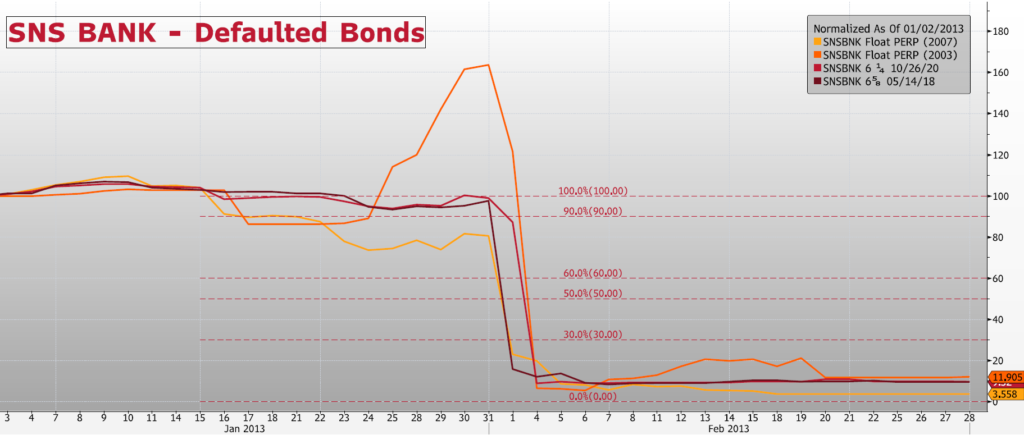

Subordinated bonds, on the other hand, are riskier because they are repaid only after senior bonds in the event of liquidation of the company. This higher risk translates into higher returns but makes subordinated bonds less suitable for investors with low risk tolerance.

Banks, intermediaries as well as investment platforms are of course obliged to inform their clients, before the investment is made, of all the potential risks to which they are about to expose their savings, by purchasing debt from an entity with a high risk of default. In the absence of information on the degree of risk of the bonds, therefore, the bank/intermediary/platform will be liable for the damage unfairly suffered by its client.

Types of Financial Claims We Handle

Equity Investments

Investing in company shares involves market volatility risks. When intermediaries fail to disclose risks tied to high-risk entities, such as Air France-KLM, they may be held liable for resulting losses.

CFDs and Investment Certificates

Leveraged instruments amplify both gains and losses, posing high risks for inexperienced investors. Significant losses, like an 80% drop in a Reverse Bonus Cap Certificate, underline the need for transparent risk communication.

Free non-binding preliminary analysis by a specialized consultant

Get Started with Confidence

Martingale Risk is here to help you fight financial injustice: complete the form below to start your journey toward rightful compensation.