Financial claims for recovering losses suffered in Equities

Let Martingale Risk help you claim what’s rightfully yours.

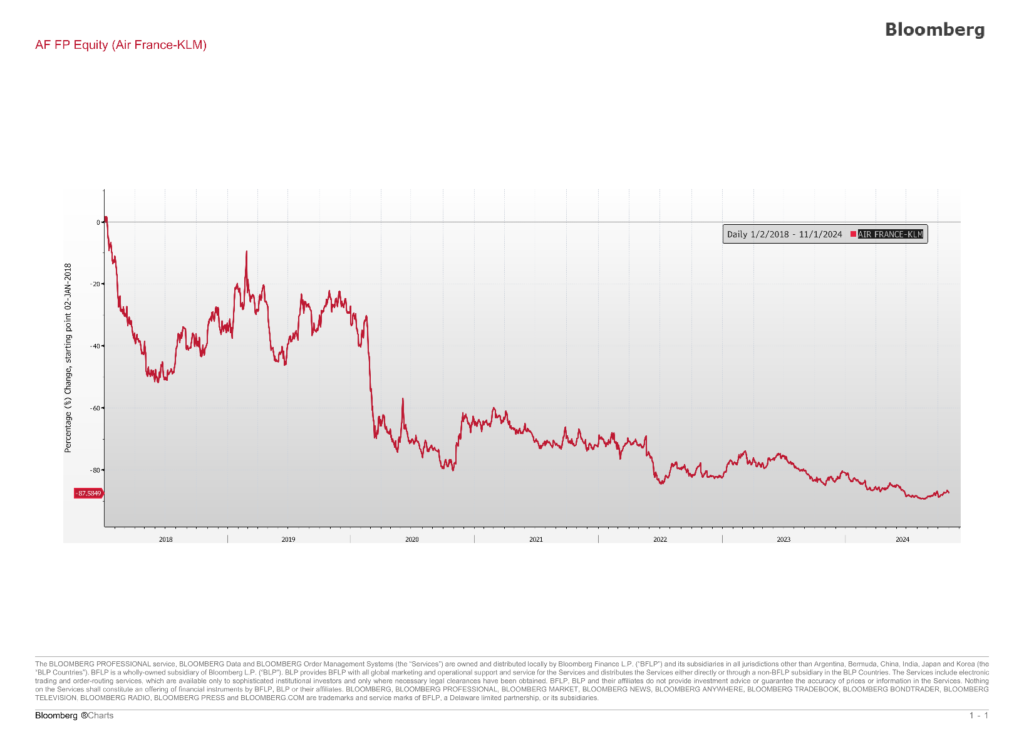

Investments in shares allow investors to acquire a direct stake in the capital of a company, becoming its shareholder. This type of investment is subject to the volatility of the stock market, where share prices can fluctuate as a result of company performance, news about the company’s future expectations or other general market factors.

The very nature of equities carries a capital risk, making them potentially more suitable for investors with a certain risk tolerance and a medium to long-term investment horizon.

Banks, intermediaries and investment platforms are of course obliged to inform their clients, before making the investment, of all the potential risks to which they are about to expose their savings by purchasing equities from an entity with a high risk of default.

In the absence of this information, therefore, the bank/broker/platform will be liable for the damage unfairly suffered by its client.

Types of Financial Claims We Handle

Bonds

Risk levels in corporate bonds depend on the issuer’s creditworthiness. High-risk bonds, such as those issued by SNS Bank N.V., require clear risk disclosure by intermediaries to avoid liability for investor losses.

CFDs and Investment Certificates

Leveraged instruments amplify both gains and losses, posing high risks for inexperienced investors. Significant losses, like an 80% drop in a Reverse Bonus Cap Certificate, underline the need for transparent risk communication.

Free non-binding preliminary analysis by a specialized consultant

Get Started with Confidence

Martingale Risk is here to help you fight financial injustice: complete the form below to start your journey toward rightful compensation.